Economic improvement awaits Powell’s ratification

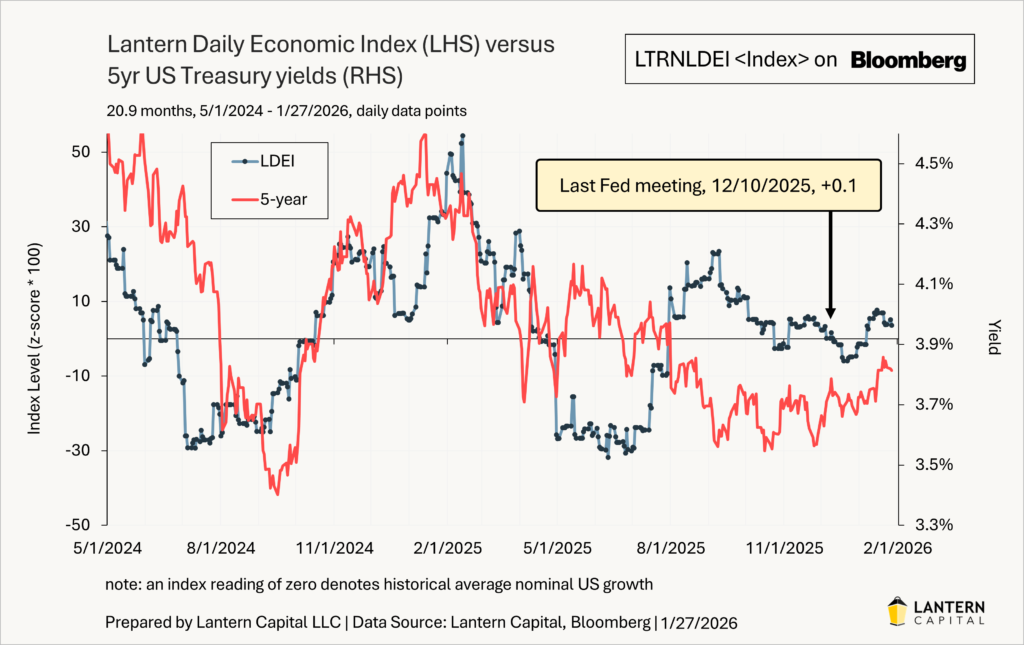

The Fed will announce the results from its two-day meeting tomorrow. As is widely accepted, they won’t change the Fed Funds rate, but I expect Jerome Powell to begin acknowledging economic strength in the press conference, which he has yet to do. Much of the rest of the FOMC already has, but it matters much more to Treasury yields what the Chair does. The last we heard from him on monetary policy was at the prior Fed meeting (12/10) where he was still trying to sell the last rate cut, leaning into economic weakness. Just days after that was finished, Federal Reserve Bank President John Williams, who lent some dovishness to get the last rate cut accomplished, started characterizing the economy as ‘turning the corner’ (Resilience speech on 12/15). I envision Powell doing something similar now that there aren’t any rate cuts that need selling and because of the economics I explain below.

What I don’t anticipate is for Powell to sound any different than he normally would despite the controversy stemming from attacks on Fed independence, pressure from the Administration to cut rates, or the limited time he has remaining in his Chairmanship term (ending 5/23/2026). Jerome Powell is a highly principled man. What President Trump and maybe even Treasury Secretary Scott Bessent doesn’t know is that the reason why Powell and the FOMC can’t cut rates like Greenspan is because this business cycle has been slowed down, presumably because the deficit is so large, covered in my prior writing, “The 6% deficit, post-lore economy”. The new Chair will be faced with the same slow business cycle down-trend that Powell was faced with and above target inflation, preventing anyone from continuous Greenspan-esque cutting until the economy demands it (Taylor Rule). No matter what the President wants, the Fed is bound on both sides. Should inflation start to reaccelerate as I expect from the large fiscal boost in the first quarter and easy financial conditions, Trump’s pressure on the FOMC to cut rates will diminish. The Administration is ultimately bound on both sides too, especially since inflation was one of the key issues that got Trump elected, and keeping the government trifecta past the mid-terms is his intense focus.

Here is what I think the FOMC is seeing with the economy:

1. Labor: The labor market has improved for four months in a way that mimics 2024’s improvement (chart below). Jobless claims are low, the unemployment rate fell -0.16% in December (more meaningful than it looks), and job openings remain in a high range that they’ve been in for two years. Recent population growth estimates from the CBO affirm that the breakeven rate of payroll growth to a stable unemployment rate is low; around +34k (Lantern calculation), meaning that average job growth over the last two months of +53k is likely enough to keep the unemployment rate steady.

2. Broader economy: The Lantern Daily Economic Index (LDEI) which tracks the entire nominal economy (i.e., including inflation) hasn’t improved much since the last FOMC meeting (+3.5 points), but more importantly, it hasn’t worsened. It remains near average nominal GDP growth. A lot of the angst from the Fed to cut rates last year came from the idea that negative payroll growth has nearly always occurred at the start of a recession. There were many prognostications that layoff announcements were set to turn into a serious downturn for the economy but that hasn’t materialized. From all six NBER monthly recession indicators falling into a drawdown last year, all but one, personal income less transfer payments, have fully recovered what they lost. One of the most important of the six, real consumer spending, has grown a strong 3.6% annualized over the last six months from being negative in May; a reliable recession signal when negative.

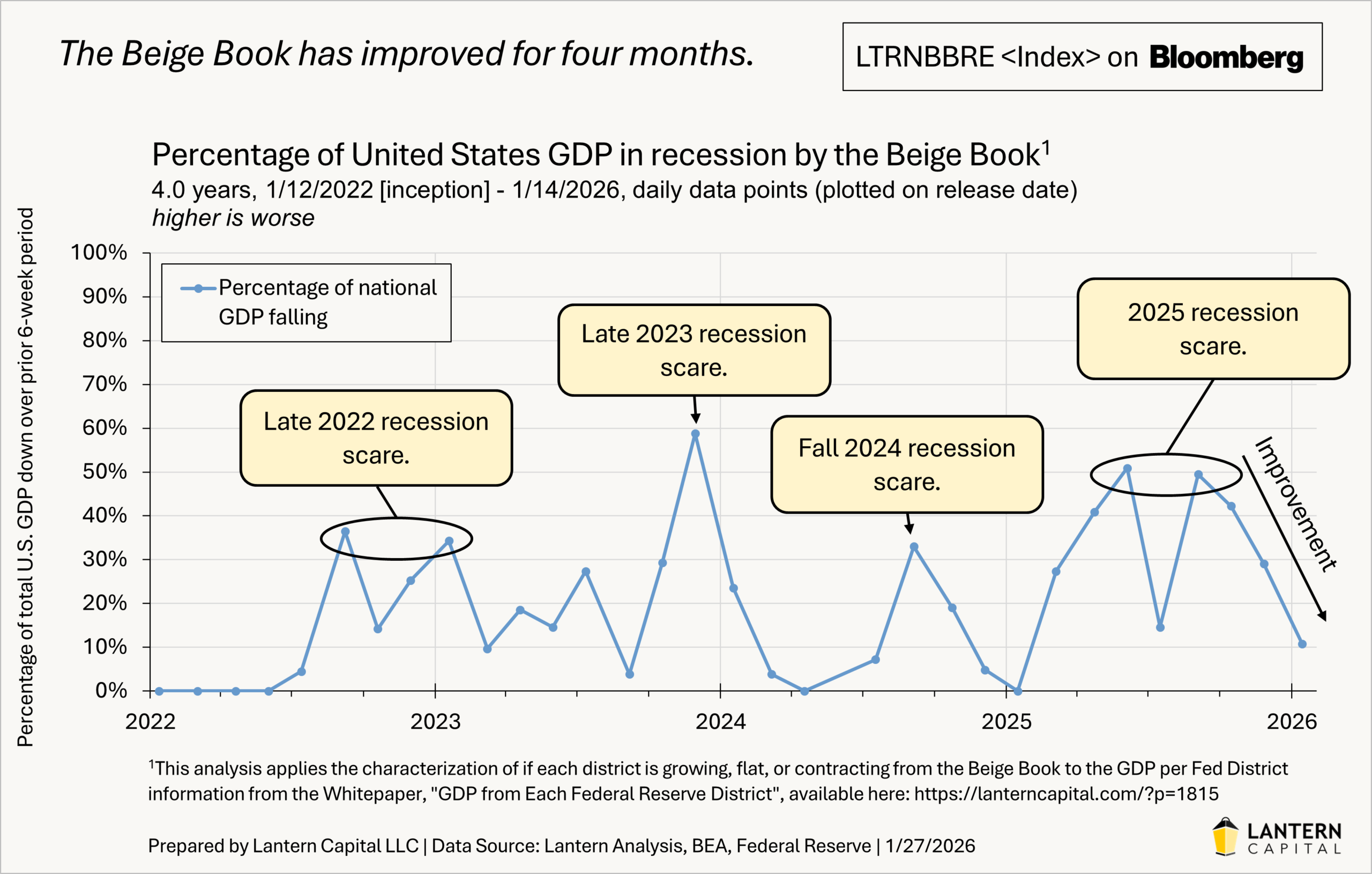

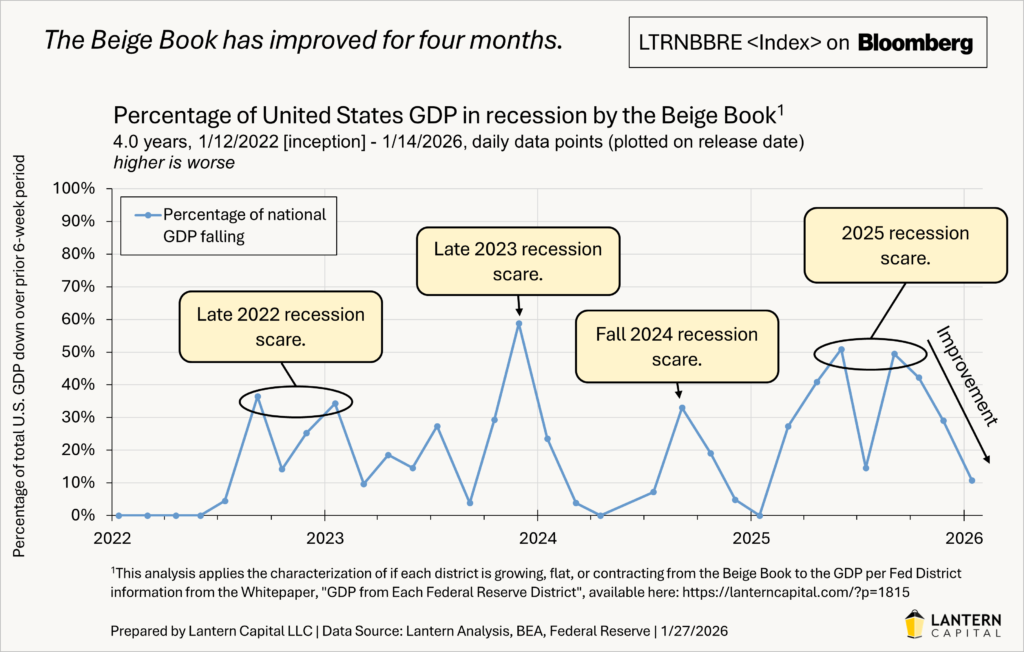

3. Fed regional reporting: A large part of the Fed’s assessment of the economy is derived from their business and community contacts. The Beige Book, which captures this, has improved considerably from mid-year which helps to confirm the trend from traditional economic statistics (chart below).

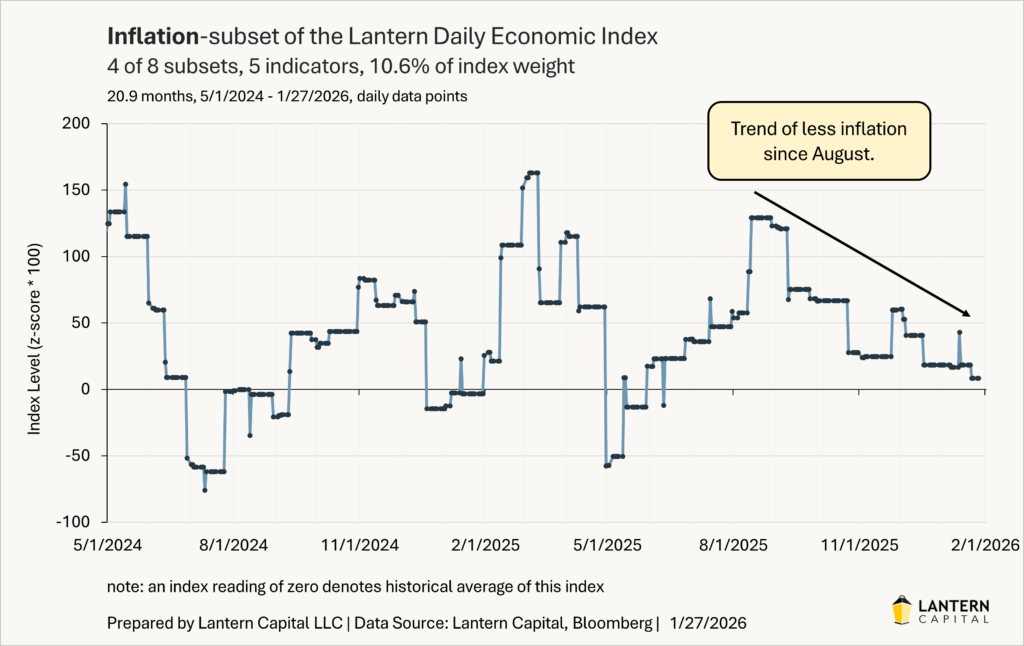

4. Inflation: The inflation subset of the LDEI has fallen considerably since August, but in opposition, inflation expectations have risen a little over the last two months. It leaves inflation over target, but also not rising.

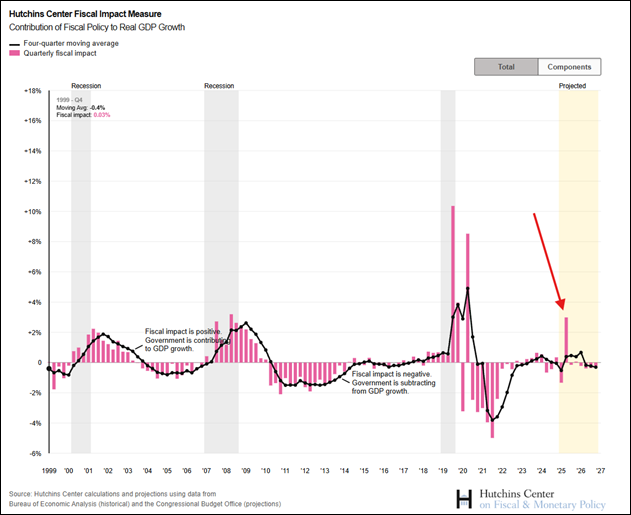

5. Outlook: Because of the One Big Beautiful Bill Act’s enactment and the government reopening (assuming it doesn’t close again), fiscal spending is estimated to add 3.0% to GDP in the first quarter (see red arrow in chart below from Brookings). Also, my observation of the “post-lore economy” is that the economy is bouncing between pessimism and optimism every 6-9 months for the last three years. Moderately easier financial conditions seem to keep rescuing the economy from a recession, leading to a boom until rates rise enough to stop it. It is hard for me to imagine that the Fed isn’t noticing this too, steering them to a positive outlook, especially given that they have just cut rates another 0.75%.

Taking these five reasons together, Jerome Powell has every reason to characterize the economy as strong in the press conference on Wednesday. There are still 1.8 future Fed rate cuts priced into the bond market. As this “post-lore economy” wave of improvement continues and affirmation from the Fed, I expect for those cuts to get priced out which would take the 2-year up to about 3.78% (taking account of term premium). Because these waves of improvement tend to go on until rates rise enough to stop them, I expect for rate raises to eventually be priced in before the economy slows again into the next recession scare and possibly even a recession (especially since credit problems started to spring up last year). The business cycle is advancing, but at a glacial rate because of the high deficit. As John Williams said last month, the economy seems to be ‘turning the corner’ and it makes sense that Powell will acknowledge that tomorrow.